Yes, for almost two years now, I’ve been hearing some pretty strange things in my profession.

From customers who are offered completely run-down boats at downright absurd prices.

And from brokers who now travel halfway around the world just to maintain their sales listings and who often sell yachts worth several hundred thousand euros just like that online.

Without the new owner ever having set foot on it.

Just put it in the shopping cart and “click”.

But are these stories really true or are they just myths that are now circulating around the marinas?

Well, we have been monitoring the market for you since the start of the pandemic and can provide you with well-founded answers.

“Evidence-based”, as they like to say these days.

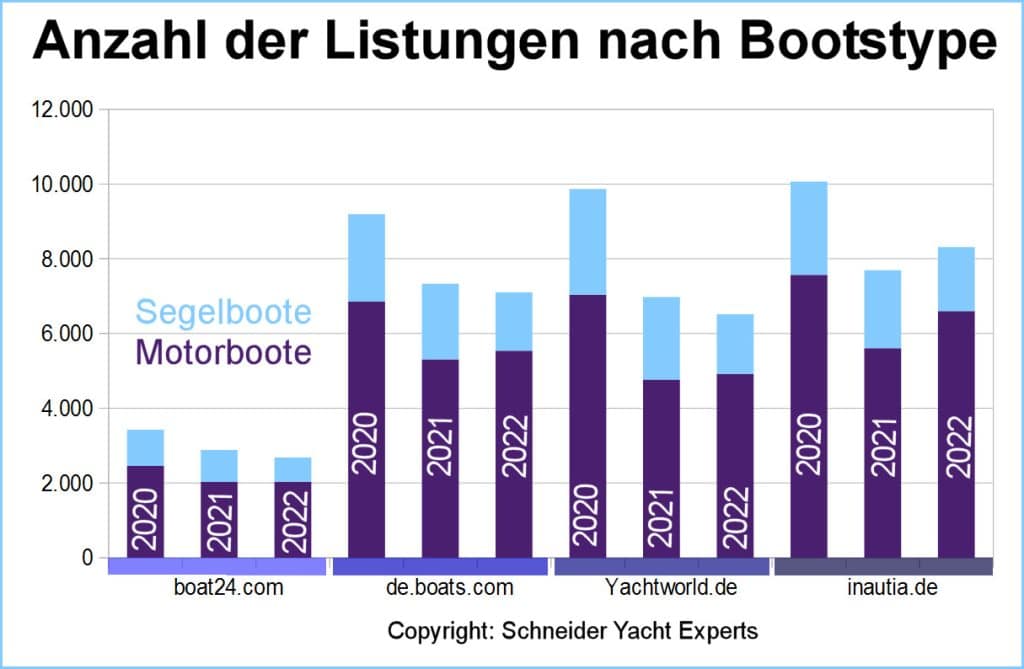

To do this, we looked at the number of listings on the major boat exchanges in our home territories of Italy and Croatia in mid-March and analyzed them separately by boat type.

We included the following:

The COVID effect in figures

The result: while boat24.com recorded a total of 3,427 listings (all size classes and years of construction) in March 2020, this figure has now fallen to 2,886, which corresponds to a drop of almost 22%.

The picture is similar on the other exchanges, which recorded a drop of between 23% and 34% in the same period.

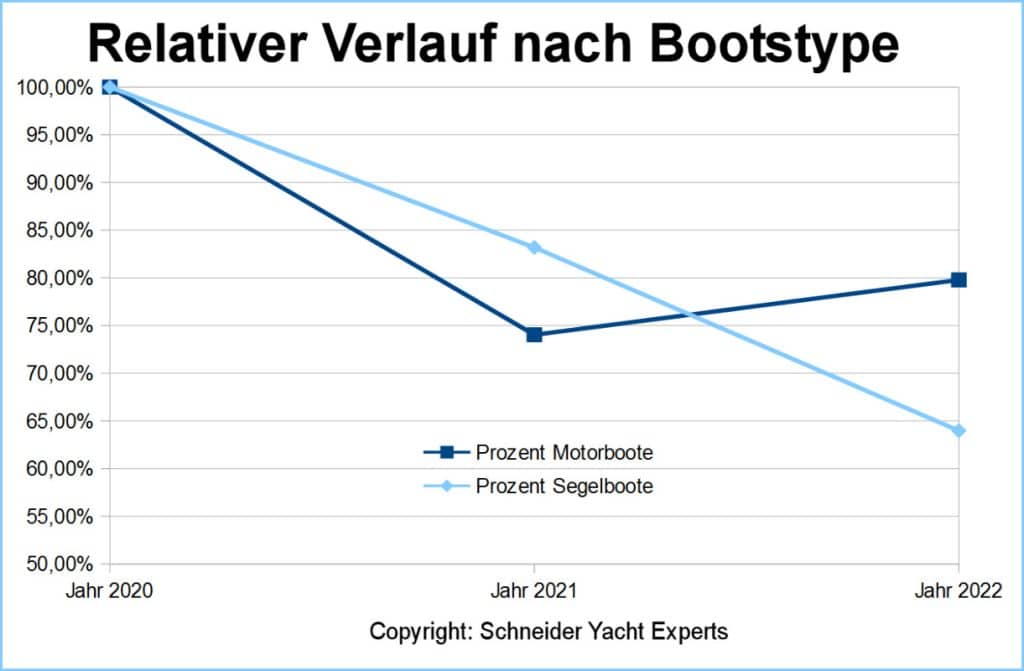

However, it becomes particularly interesting when you look at the development of listings across all exchanges, broken down into motor and sailing boats.

For example, the number of motorboats for sale (here too, all size classes and years of construction) fell to around 74% in March 2021 compared to the same period in 2020, but then rose again to just under 80%.

The picture is quite different for sailboats, however, whose population initially “only” decreased to around 83 percent in 2021.

In contrast to motorboats, however, this trend has continued up to the present time and, at around 64%, has even gained further momentum compared to 2020.

A third of the once available stock of sailing boats was therefore swept off the market by the COVID effect.

Quo Vadis boat market

Whether and to what extent this can be used to forecast developments in the near future is a big question mark in view of the current political and economic upheavals.

There is no doubt that buyers have already adopted a somewhat more cautious and wait-and-see attitude.

In the medium term, however, it can be assumed that the current trends will most likely reverse again within 2 to 3 years.

This is because the increased euphoria of recent years has often been accompanied by a somewhat naïve approach to the running costs of a yacht.

And I fear that some people will soon become disillusioned in this respect.

Especially as, in addition to rising fuel prices and other uncertainties, marinas are also reacting to the increasing demand for berths and raising their rates sharply again.

With this in mind…

…enjoy life and your yacht as much and as often as you can.

Yours sincerely

Ing. Ingolf Schneider, MASc (AssocRINA)

Certified surveyor for boats and yachts up to 24m (LLoyds Maritime Academy, American Boat and Yacht Council).

Member of the Royal Institution of Naval Architects.