Similar to cars or real estate, boats and yachts also regularly require a valuation – be it for more informative purposes (e.g. in the course of a purchase or sale) or because there is a compelling necessity (e.g. in the case of insurance or inheritance matters).

And just as individual as the reasons for owning a yacht are, so individual and sometimes complicated is its valuation. In this article, I will shed light on the various reasons for a yacht valuation, identify specific challenges, the factors that influence the value of a yacht and present suitable methodologies for a valuation.

Table of contents

Occasions for the valuation of boats and yachts

As mentioned at the beginning, the reasons for the valuation of boats and yachts can vary. Typical reasons are

Buying or selling: Determining a fair market value to guide the seller and buyer.

Inheritance: In the event of an inheritance, the value of the yacht must be determined for estate settlement or inheritance tax purposes.

Insurance: Insurance companies may require a valuation to determine the sum insured or to settle a claim.

Financing: Banks often require a valuation as a basis for granting loans.

Legal disputes: A yacht valuation may also be necessary in the event of divorce or other legal disputes.

Specific challenges in the evaluation

The valuation of boats and yachts brings with it some specific challenges that make the process far more complex and difficult than the valuation of cars, for example.

While extensive statistical market data and electronic valuation systems are available for cars, there is far less transparency when it comes to the real market conditions for boats and yachts.

One of the reasons for this is that there are far fewer transactions on the market for used boats that allow a reliable statistical evaluation of sales prices. And the larger and more expensive a yacht is, the thinner the air in terms of comparative data. This extends to so-called “one-off builds” (i.e. individual shipyard builds that have been completely tailored to the owner’s needs), where there is de facto no comparative data at all that could be applied 1:1.

A further challenge lies in the consideration of the relevant market – because while the valuation of cars or real estate is generally limited to regional market conditions, international trends and tendencies must often be taken into account for boats and yachts, especially as purchases and sales across half the globe are not uncommon, particularly in the case of larger yachts.

Factors that influence the value of a yacht

The value of a yacht can be influenced by numerous factors:

Age and condition: As with almost all vehicles, age is a decisive factor. However, the condition of yachts, which can often last for generations if well looked after, plays a greater role.

Manufacturer and model: Certain manufacturers and models have a reputation that increases their value.

Market situation: Supply and demand influence the price. The situation can vary greatly depending on the market segment.

Equipment and materials: High-quality additional equipment is reflected in the value just as much as the materials used and their workmanship

Maintenance history: A complete maintenance history can sometimes have a considerable influence on the value, as it allows future maintenance costs to be estimated.

Berth: In individual cases, yachts are sometimes marketed together with the berth, which can of course also have a very strong influence on the value.

Typical depreciation for boats and yachts

The loss in value of a yacht can vary greatly, but there are certain empirical values and rules of thumb that allow a first rough estimate: new yachts usually lose value quickly in the first few years, often an average loss in value of about 12 to 16 percent in the first year and about 6-10 percent in each of the following years is assumed – whereby a distinction must already be made here according to the type and size of the yacht (see also tables below).

After about 10 years, the depreciation finally slows down considerably and the value stabilizes, provided the yacht is well maintained and cared for.

Table 1*: Loss in value of yachts by size

| Length over all | 1 year | 3 years | 7 years |

|---|---|---|---|

| 30-40 feet | 19% | 28% | 45% |

| 51-50 feet | 9% | 21% | 47% |

| 51-60 feet | 15% | 33% | 45% |

Table 2*: Relative value of yachts by type

| Type | 3 years | 5 years | 10 years |

|---|---|---|---|

| Sport boats/Bowriders | 66% | 57% | 34% |

| Cabin boats (motor) | 65% | 51% | 40% |

| Sailboats/yachts** | 91% | 85% | 73% |

*) Data situation 2021

**) Striking recoverability in the course of the “Covid effect” for used yachts

ATTENTION: Historical data without guarantee for the current validity!

Methodologies for evaluating boats and yachts

Different methods are available to determine the value of a yacht, depending on the reason for the valuation and the individual circumstances to be taken into account. The most commonly used methods are

The comparative value method: Comparable yachts and their sales prices are used here.

The income capitalization approach: This method is sometimes used if the yacht is used commercially to generate income, for example in the case of charter yachts.

The utilization procedure: If a yacht is no longer seaworthy or can only be brought back to seaworthy condition with excessive effort, its value is determined by the sum of the salvageable individual components less any disposal costs (residual value assessment).

A weighted mixed calculation from a combination of the valuation models mentioned can also make sense in individual cases in order to obtain a realistic assessment.

Procedure of a yacht valuation

Appraisal and sea trial

The central component of every yacht valuation is a detailed on-site inspection.

Everything that has a significant influence on the value is inspected, from the condition of the underwater hull to the functionality of the most important on-board systems.

If possible, a sea trial is also carried out to check the engines and drive train.

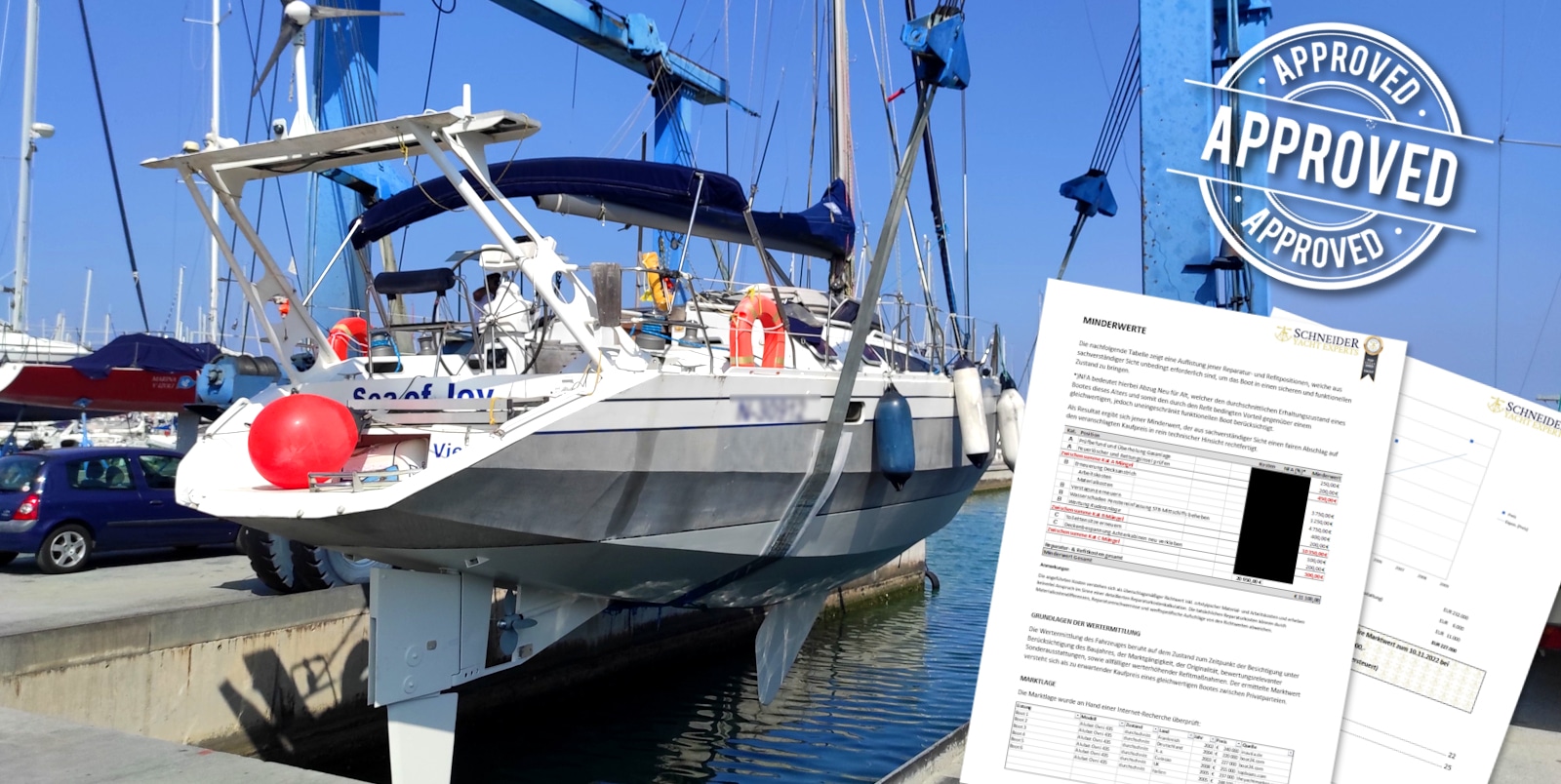

Calculation of reduced value

If significant defects are identified during the appraisal, these must be assessed in terms of their value impairment.

For this purpose, the expected repair costs are first determined and then their discount factor is set.

The following applies: the greater the impact of a defect on seaworthiness or the more relevant the affected system is for the valuation, the higher the proportionate reduction in value is to be applied.

It is also necessary to clarify what condition a buyer expects depending on the age and condition of comparable yachts on the market in order to apply realistic discount factors.

The market analysis

Once all valuation-relevant factors have been recorded, the next step is to analyze the current market conditions. This ranges from internet research on the relevant sales portals, through to questioning brokers and own market observations and places high demands on the experience of the valuer.

This is because currently published sales prices initially only reflect the seller’s expectations and are often far removed from the prices that can actually be achieved. And especially in economically volatile times, the valuer must also have a feel for current trends and medium-term market tendencies in order to determine an accurate value. Medium-term because normal service life is also included in the value considerations.

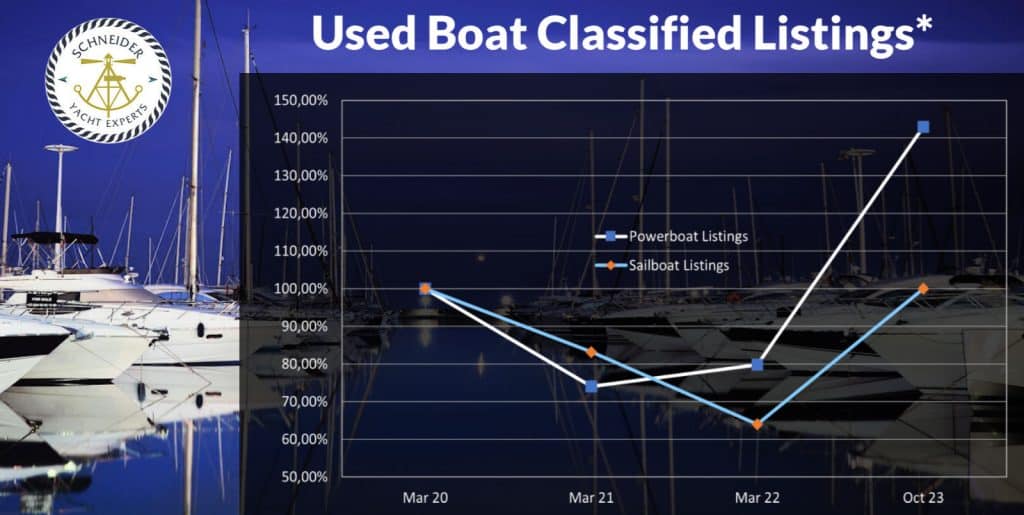

To this end, we also regularly survey the development of sales inventories in our domestic markets, for example – because the following applies to boats and yachts as well: the higher the supply, the more pressure there is on prices.

The valuation report

Finally, the valuation process is concluded with the preparation of the valuation report, in which the condition of the boat or yacht and all valuation-relevant factors are comprehensively and comprehensibly documented.

Any extraordinary influences are also described in detail and their value taken into account.

Frequently asked questions about the valuation of boats and yachts

Who can help me with the valuation of my yacht?

Answer: In principle, the valuation of yachts is not subject to any specific regulations and can therefore be carried out by any competent person or organization. Examples include experienced brokers or yacht appraisers. Only in inheritance, legal or tax matters is a valuation by a certified or sworn expert usually required. In your own interest, however, you should always ask for references and appropriate proof of qualifications before commissioning a valuation.

Is an appraisal required for the valuation of a boat or yacht?

Answer: Yes, the on-site appraisal is an essential part of every yacht valuation and is therefore indispensable. This is the only way to ensure that all valuation-relevant factors are correctly recorded and taken into account in the report.

What does a valuation report for a boat or yacht cost?

Answer : The cost of valuing a boat or yacht depends primarily on its size and equipment. In addition, type and marketability as well as any travel expenses also play a role. As a rough guide, however, costs of approx. 14 to 18 euros per foot can be assumed.

Conclusion

In summary, it can be said on the basis of the above considerations that the valuation of yachts is a complex matter that depends on numerous factors and requires comprehensive expertise.

If you are interested in a valuation yourself, it is advisable to discuss the purpose and general conditions in detail in advance with a competent expert or yacht valuer of your choice and agree on the procedure.

And last but not least: be careful with tempting offers such as remote valuations. Although these can be a certain orientation aid in determining the value of smaller, series-produced boats up to approx. 8 meters in length, they certainly reach their limits when it comes to larger yachts.